Buying a home, especially for first-time buyers, can be a daunting task. With rising property prices and stringent lending criteria, many aspiring homeowners find themselves struggling to secure a mortgage loan on their own. This is where parental support can be invaluable, and one option is to have your parents co-sign the mortgage loan with you for a mortgage with my parents.

Co-signing a mortgage with my parents essentially means that your parents become joint borrowers or co-borrowers on the loan. This arrangement allows lenders to consider your combined incomes and credit scores when evaluating your eligibility for the mortgage with my parents.

- Combined income: The lender will assess the combined income of you and your parents to determine your collective ability to make the monthly mortgage payments.

- Credit scores: Both your and your parents’ credit scores will be evaluated, as they reflect your overall creditworthiness and borrowing history.

- Employment stability: Lenders may require proof of stable employment and income for all co-borrowers.

- Existing debt obligations: Any outstanding debts or financial obligations of you and your parents will be factored into the affordability assessment.

Here’s an example scenario to illustrate the co-signing process:

Example: Sarah, a recent college graduate, wants to purchase her first home but struggles to qualify for a mortgage due to her entry-level income and limited credit history. Her parents, David and Emily, agree to co-sign the mortgage loan with her. By combining Sarah’s income with her parents’ stable earnings and excellent credit scores, the lender approves the loan, allowing Sarah to become a homeowner sooner than she could have on her own.

Getting a Gift for the Down Payment: Parental Assistance for the Initial Hurdle

One of the most significant barriers to homeownership, especially for first-time buyers, is saving enough money for the down payment. This upfront cost can be a substantial financial burden, often requiring years of diligent saving. Fortunately, parents can provide valuable assistance in this regard by gifting funds to their children for the down payment on a mortgage with my parents.

One of the most significant barriers to homeownership, especially for first-time buyers, is saving enough money for the down payment. This upfront cost can be a substantial financial burden, often requiring years of diligent saving. Fortunately, parents can provide valuable assistance in this regard by gifting funds to their children for the down payment.

Here are some key considerations when receiving a gifted deposit from your parents:

- Documentation: Lenders will typically require a gift letter from your parents, stating that the funds are genuinely a gift and not a loan that needs to be repaid. Additionally, you may need to provide bank statements or other documentation to trace the source of the gifted funds.

- Acceptable sources: Most lenders will accept gift funds from immediate family members, such as parents, grandparents, siblings, or children. However, they may scrutinize gifts from more distant relatives or non-family members.

- Minimum borrower contribution: Some lenders may require you, as the borrower, to contribute a certain percentage of the down payment from your own funds, even if you’re receiving a gift from your parents.

- Larger down payment benefits: A larger down payment not only reduces the overall loan amount but can also help you avoid paying private mortgage insurance (PMI), which can save you thousands of dollars over the life of the loan.

Having Parents Secure a Second Mortgage: Exploring Piggyback Loans

While co-signing and gifting funds are popular options for parental assistance, some families may prefer an alternative route: having the parents secure a second mortgage with my parents, also known as a piggyback loan. This approach involves obtaining two separate mortgage loans – a primary mortgage and a second, smaller loan – to finance the home purchase

While co-signing and gifting funds are popular options for parental assistance, some families may prefer an alternative route: having the parents secure a second mortgage, also known as a piggyback loan. This approach involves obtaining two separate mortgage loans – a primary mortgage and a second, smaller loan – to finance the home purchase.

The concept of piggyback loans is relatively straightforward: the primary mortgage typically covers 80% of the home’s value, while the second loan, often secured by the parents, covers a portion of the remaining 20% down payment. This arrangement can be advantageous for first-time buyers who may not have enough funds for a substantial down payment but still want to avoid paying private mortgage insurance (PMI).

Here’s an example to illustrate how piggyback loans work:

Example: John and Jane want to purchase a home valued at $300,000. They can secure a primary mortgage for 80% of the value ($240,000) from a lender. However, they only have enough savings for a 10% down payment ($30,000). To cover the remaining 10% ($30,000) and avoid PMI, John’s parents decide to take out a second mortgage for that amount, effectively providing the additional down payment funds.

By splitting the down payment into two loans, piggyback mortgages can offer several potential benefits:

- Avoiding PMI: With a combined down payment of 20% or more, borrowers can bypass the requirement for private mortgage insurance, potentially saving thousands of dollars over the loan’s lifetime.

- Smaller upfront costs: The second mortgage allows parents to contribute a portion of the down payment, reducing the initial financial burden on the first-time buyers.

- Tax advantages: Depending on the specific situation, the interest paid on the second mortgage may be tax-deductible for the parents, providing an additional financial benefit.

However, it’s important to note that piggyback loans also come with additional risks and responsibilities. First-time buyers and their parents should carefully consider the following:

- Double mortgage payments: With two separate mortgage loans, there will be two sets of monthly payments, potentially increasing the overall financial obligation.

- Increased debt burden: Taking on a second mortgage adds to the overall debt load, which can impact future borrowing capabilities and financial flexibility.

- Default risks: If the first-time buyers default on their primary mortgage, the parents’ second mortgage could also be at risk, potentially leading to foreclosure proceedings.

Other Parental Support Options

- Family offset mortgage: Some lenders offer specialized mortgage products that allow parents to use their savings or home equity as collateral, potentially helping their children secure better interest rates or larger loan amounts on a mortgage with my parents.

- Living with parents to save for a down payment: Many young adults choose to live with their parents for an extended period, allowing them to save a significant portion of their income towards a future down payment.

- Borrowing from retirement accounts: Parents may consider tapping into their retirement accounts, such as 401(k) plans or individual retirement accounts (IRAs), to access funds for assisting their children with a down payment. However, this approach should be carefully evaluated, as it can have significant tax implications and potentially impact retirement savings.

- Having parents purchase the home as an investment property: In some cases, parents may choose to purchase a property themselves and then rent it out to their children, effectively providing housing while retaining ownership of the asset.

- Family offset mortgage: Some lenders offer specialized mortgage products that allow parents to use their savings or home equity as collateral, potentially helping their children secure better interest rates or larger loan amounts.

It’s important to thoroughly research and understand the potential benefits, risks, and legal implications of each option before proceeding. Additionally, seeking professional advice from financial advisors, tax experts, and real estate professionals can help navigate these complex decisions and ensure the chosen path aligns with your family’s long-term financial goals.

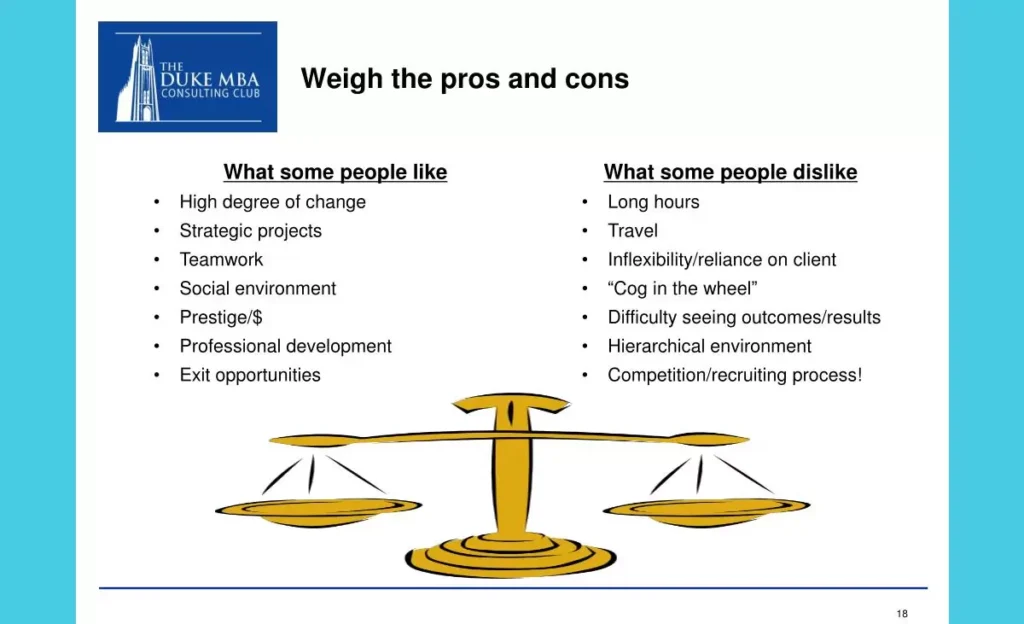

Weighing the Pros and Cons: Balancing Opportunities and Risks

While parental assistance can undoubtedly open doors to homeownership for first-time buyers, it’s crucial to carefully weigh the potential advantages and drawbacks before making any commitments. Let’s explore some of the key pros and cons:

Potential Advantages:

- Boosting affordability: By combining incomes, receiving gifted funds, or securing additional loans, parental support can increase your borrowing capacity

- Building credit history: Co-signing a mortgage or being a co-borrower can help first-time buyers establish and build their credit histories, which can be beneficial for future financial endeavors.

- Achieving homeownership sooner: With parental assistance, many first-time buyers can purchase a home earlier in life, potentially taking advantage of lower property prices and building equity sooner.

- Family support and collaboration: The process of securing a home with the help of parents can foster stronger family ties and a sense of shared accomplishment.

Potential Risks and Downsides:

- Financial strain on parents: Depending on the chosen assistance method, parents may be taking on significant financial obligations or putting their own assets at risk.

- Strained family relationships: Disagreements or misunderstandings regarding repayment responsibilities, property ownership, or decision-making can strain family dynamics.

- Limiting future financial flexibility: Co-signing or taking on additional debt can impact the borrowing capacity of both the first-time buyers and their parents, potentially limiting future financial opportunities.

- Credit score impact: Any missed payments or defaults on a co-signed or jointly held mortgage can negatively impact the credit scores of all parties involved.

- Legal and tax implications: Depending on the specific arrangement, there may be legal and tax considerations that require professional guidance and careful navigation.

It’s essential to have open and honest discussions with your parents about the potential risks and rewards of each assistance option. Setting clear expectations, establishing boundaries, and seeking professional advice can help mitigate potential conflicts and ensure that the chosen path aligns with the long term financial goals of all parties involved.

Conclusion: Embracing the Journey to Homeownership with Family Support

Achieving the dream of homeownership can be a daunting task, especially for first-time buyers navigating the complexities of the real estate market and mortgage lending landscape. However, parental support can provide a valuable lifeline, offering various options to overcome financial hurdles and unlock the door to homeownership.

From co-signing mortgage loans and gifting down payment funds to securing additional mortgages or exploring alternative assistance methods, the paths to parental support are diverse. Each option comes with its own set of considerations, risks, and potential rewards that must be carefully evaluated in the context of your unique circumstances.

So, if you find yourself asking, “Can I get a mortgage with my parents’ help?” the answer is a resounding yes but it’s crucial to approach this endeavor with careful consideration, planning, and a deep understanding of the implications for all parties involved. With the right preparation and mindset, the path to homeownership can be a rewarding and fulfilling experience that transcends the mere acquisition of a property.