Have you ever noticed strange acronyms like “ARE NWEDI” on your bank statement and wondered what they mean? Decoding the cryptic codes on bank statements can be confusing, but understanding ARE NWEDI payments is crucial for effectively managing your finances.

What is ARE NWEDI?

ARE NWEDI stands for Automated Recurring Entry Non-Window Electronic Data Initiated. It’s a type of ACH (Automated Clearing House) payment that facilitates recurring electronic data debits from your account. ARE NWEDI transactions are commonly used for subscriptions, utility bills, and other regular payment obligations you’ve authorized in advance.

For example, if you’ve signed up for a monthly meal kit delivery service or pay your cable bill automatically, those charges would likely appear as “ARE NWEDI” on your bank statement. The code indicates an electronic data transfer initiated by the merchant per your pre-approved agreement.

Common ARE NWEDI Use Cases

ARE NWEDI payments are a convenient way for businesses and consumers to handle recurring transactions. Some typical use cases include:

- Subscription services (streaming, memberships, etc.)

- Utility payments (electricity, gas, water, etc.)

- Telecom bills (cable, internet, phone)

- Insurance premiums

- Loan payments

- Health club/gym fees

Why ARE NWEDI Payments Matter

While the acronym may look confusing, it’s important to understand ARE NWEDI charges on your statements. Here’s why they matter:

- Monitor Recurring Costs: With automatic payments, it’s easy to lose track of how much you’re being charged regularly. Reviewing NWEDI entries keeps you aware of recurring expenses.

- Prevent Unintended Renewals: Some subscriptions auto-renew annually or roll over if not cancelled properly. Catching NWEDI charges prevents surprises.

- Identify Potential Fraud: Unfortunately, unauthorized NWEDI payments can sometimes slip through if you’re not vigilant about checking statements. Early detection is key.

- Verify Billing Amounts: Even legitimate NWEDI charges could have incorrect billing amounts due to errors. You can dispute overcharges promptly.

Basically, understanding your bank statement and NWEDI codes empowers you to properly manage authorized payment obligations while quickly catching any irregularities.

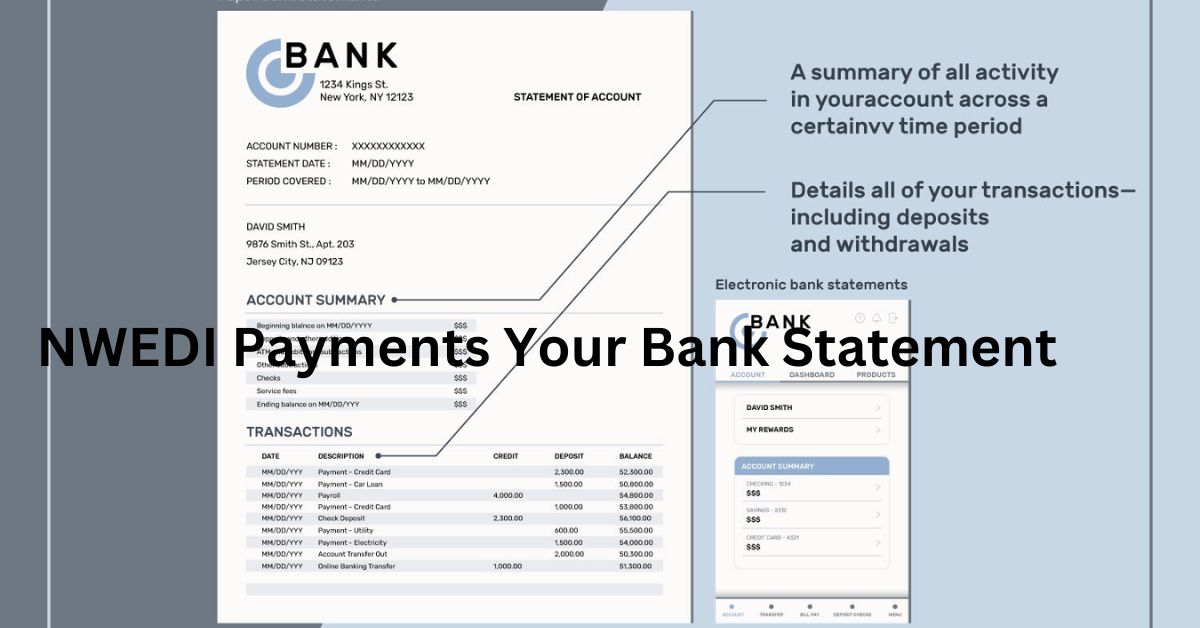

Deciphering Your Bank Statement

While specific formats vary across banks, most bank statements follow a similar structure when listing transactions. Here’s a quick guide to common codes and details:

Transaction Description Column

- This lists the payee name and purchase details

- NWEDI charges show as “NWEDI XXXXXXCOMPANY” where X’s represent the business name

- Statements truncate long descriptions, so check monthly to see full payee info

Payment Category/Type

- This column may include codes like “NWEDI”, “ACH”, or “DEBIT”

- These indicate payment processing method

Amount

- Debits are shown as negative numbers, often with formatting like -$29.99

Posting Date

- Shows date the transaction cleared and posted to account

- Merchant initiation date may be a few days prior

Here’s an example bank statement screenshot with key areas highlighted:

Show Image

Recognizing Legitimate ARE NWEDI Charges

Not all NWEDI charges are cause for concern. In fact, most are likely legitimate recurring payments you’ve pre-approved like:

- Monthly subscriptions (Netflix, Spotify, etc.)

- Utility bills (electric, water, cable/internet)

- Loan payments (auto, mortgage, student, etc.)

- Insurance premiums

- Membership fees (gyms, clubs, etc.)

To verify a charge, simply cross-reference the payee name and amount against your expected recurring payments. If it matches signed paperwork or your account agreement with that business partner, it’s likely an authorized NWEDI debit.

You can also contact the merchant directly to confirm an NWEDI payment. Reputable companies should be able to look up the details and payment authorization tied to your account.

Spotting Unauthorized ARE NWEDI Debits

On the flip side, certain NWEDI charges should immediately raise red flags if you don’t recognize the payee or transaction amount. Signs of potentially unauthorized or fraudulent NWEDI activity include:

- Payments to unfamiliar businesses: If you don’t have an account or relationship with the listed merchant, it’s likely fraud.

- Amounts inconsistent with expected charges: Even slightly deviating amounts could signal an issue.

- Multiple NWEDI charges from the same payee: Most subscriptions only charge once per billing cycle.

- International or unusual payee business names: Scrutinize charges from странный or ФэйкКомпани type names.

Basically, any NWEDI entry that doesn’t match up to your payment records and billing agreements bears further investigation. The sooner you can identify and report unauthorized activity, the better.

Taking Action on Questionable Payments

If you do spot a suspicious or invalid NWEDI charge on your statement, it’s important to act quickly to resolve the issue and prevent further damage. Here are the typical steps to take:

- Contact Your Bank Immediately As soon as you identify an NWEDI charge you didn’t authorize, call your bank or visit a branch to officially dispute the transaction. They’ll likely need:

- The posting date and amount

- Payee name and details

- A brief explanation of the issue

- Provide Supporting Documentation Your bank may require written confirmation and documentation. Be prepared to send:

- A signed statement describing the unauthorized activity

- Copies of any billing statements or contracts related to the payee

- Details on any communications with the merchant attempting to resolve the issue

- Understand Your Rights and Protections Federal regulations like the Electronic Funds Transfer Act provide legal protections against unauthorized electronic payments. Familiarize yourself with your rights.

- Take Preventative Measures To avoid similar issues in the future:

- Update payment details and automatic billing info when cards expire

- Set up account alerts for large transactions or NWEDI activity

- Review statements regularly and promptly dispute any new unauthorized charges

- Consider using virtual debit/credit cards for online payment security

By catching NWEDI issues promptly and following proper procedures, you can resolve unauthorized charges and make it more difficult for unscrupulous parties to defraud you going forward.

Case Study: Spotting and Resolving NWEDI Fraud

To illustrate the process of identifying and resolving unauthorized NWEDI charges, let’s look at a hypothetical example:

Sarah’s bank statement showed an NWEDI charge for $54.99 from “GAMMERSTASH SUBSCRIPTIONS.”

Sarah had signed up for a videogame-related newsletter and merchandise club called GamerStash, so the name seemed plausible. However, she knew the membership was supposed to be $9.99 per month.

Following the steps above, Sarah immediately called her bank’s fraud hotline to dispute the $54.99 charge as unauthorized, as it far exceeded her agreed membership fee. She also sent the bank copies of her original GamerStash sign-up order showing the $9.99 price.

The bank accepted her claim, crediting back the $54.99 while initiating a investigation into the NWEDI payment. Turns out GamerStash had suffered a data breach, and scammers were attempting to process fraudulent NWEDI charges to compromised accounts.

By acting quickly on the inflated charge amount, Sarah avoided further NWEDI fraud attempts on her account. She also learned to closely scrutinize all NWEDI charges going forward.

This illustrates the importance of vigilance with NWEDI charges. Even if the payee sounds plausible, unauthorized activities can occur through payment processing system vulnerabilities or third-party data breaches.

Building Trust with Thorough NWEDI Monitoring

While scrutinizing bank statements for confusing NWEDI codes isn’t the most exciting task, it’s a critical component of safeguarding your finances in our electronic data and payment driven world.

By understanding how to recognize valid recurring NWEDI charges from suspicious ones, you can:

- Prevent unintended renewals an

- Prevent unintended renewals and billing errors

- Quickly identify unauthorized fraudulent activity

- Take appropriate action to dispute invalid charges

- Enhance security of your payment data and processes

Regularly auditing NWEDI entries on statements is simply good financial hygiene. It builds trust that your authorized recurring payments are processing correctly while allowing you to swiftly mitigate any issues.

Fortunately, most consumer banks provide robust electronic transaction monitoring and fraud protection services. By combining diligent personal oversight with your bank’s security measures, you can confidently engage in the convenience of automated NWEDI payments while minimizing risks.

NWEDI Payments: Enhancing Business Relationships

For businesses, understanding the NWEDI payment process is also crucial for maintaining positive cash flow and relationships with partners and customers. Automated Clearing House (ACH) transfers, including NWEDI debits, offer an efficient way to facilitate:

- Recurring Revenue Streams: Subscription models, SaaS fees, installment plans, etc.

- Streamlined B2B Collections: Pay vendors, suppliers, and contractors seamlessly

- Enhanced Customer Experience: Simplify billing and payment obligations

When leveraged properly through secure EDI payment systems, NWEDI transactions reduce manual effort while improving reliability of receivables and payables.

However, failed NWEDI attempts, returns, or unauthorized adjustments can quickly disrupt operations and accounts receivable. That’s why it’s equally important for businesses to monitor NWEDI activity and resolve any issues promptly with customers or partners.

Mastering your NWEDI workflow prevents revenue leakage and strain on business relationships. It ensures successful execution of payment agreements while building trust through transparent, accurate financial data exchanges.

The Future of Streamlined NWEDI Processing

As consumers and businesses alike become more reliant on electronic payment methods, the NWEDI process will likely continue evolving to meet demands for faster, more secure, and more seamless transactions.

Emerging financial technologies could further enhance NWEDI exchanges through innovations like:

- Blockchain integration for decentralized, immutable payment ledgers

- AI and machine learning for intelligent fraud detection

- Digital wallets and P2P apps creating new consumer payment ecosystems

- Unified global payment standards across countries and currencies

- Internet of Things (IoT) connectivity linking smart devices to payment systems

While change is inevitable, understanding today’s NWEDI underpinnings provides a solid foundation to embrace new advances and capabilities. Prioritizing payment literacy today positions you to reap the benefits of NWEDI as it transforms tomorrow.

Key Takeaways: Mastering NWEDI Payments

In our modern financial system driven by electronic data and automated processes, it’s more important than ever to understand the mechanics behind common bank codes like NWEDI. By decoding these recurring payment descriptors, you can:

- Monitor and verify valid automated payment obligations

- Quickly identify potential unauthorized fraudulent charges

- Take proper steps to dispute errors or illicit activities

- Build trust through transparent, accurate financial data exchanges

- Position yourself to capitalize on future payment process innovations

While the acronyms may seem confusing at first, a little NWEDI payment literacy goes a long way toward effectively managing your money, security, and business relationships in our increasingly digital world.

What are your experiences with monitoring NWEDI entries or resolving payment issues? Let me know in the comments! And check out these other resources for mastering your finances…

“Meet Alena Genefair, a seasoned finance expert with over five years of experience and the esteemed author behind FinanceHookup. With a wealth of knowledge in financial management, investment strategies, mortgages, and banking, Alena provides insightful perspectives to readers. Her expertise helps individuals navigate the complexities of personal finance with clarity and confidence.”