Buying a home is an exciting milestone, but the mortgage application process can often feel daunting and overwhelming. One of the most common questions homebuyers have is: “How long does it take to get approved for a mortgage?” The answer, unfortunately, isn’t a simple one – the timeline can vary significantly based on several factors. However, understanding these factors can help you plan and prepare for a smoother process.

The Average Timeline for a Mortgage Application

On average, the mortgage application process typically takes anywhere from 30 to 60 days from start to finish. However, this is just a general range, and the actual timeline can be shorter or longer depending on your specific circumstances.

Factors That Influence the Mortgage Application Timeline

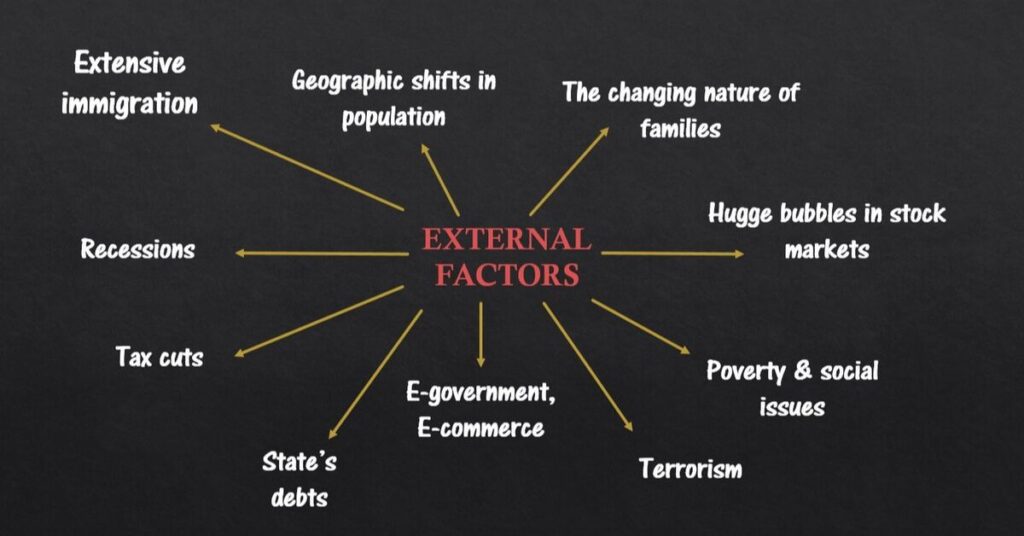

Several key factors can impact how long your mortgage application takes:

- Loan Type: The type of loan you’re applying for can affect the timeline. For example, conventional loans may move faster than government-backed loans like FHA or VA loans, which often require additional documentation and processing time.

- Credit Score and Financial Documentation: A higher credit score and well-organized financial documentation can expedite the process, as lenders will have an easier time verifying your creditworthiness and income.

- Property Type: The type of property you’re purchasing (single-family home, condo, etc.) can also impact the timeline. For example, condo purchases may require additional documentation and review by the lender.

- Lender’s Workload and Efficiency: The efficiency and workload of the lender you choose can significantly impact the timeline. Some lenders may be able to process applications faster than others.

- Underwriting and Appraisal Process: The underwriting process, where the lender thoroughly reviews your application and documentation, can take several weeks. Additionally, the appraisal process, which determines the value of the property, can add further delays if there are scheduling issues or additional appraisal requirements.

Step-by-Step Breakdown of the Mortgage Application Process

To better understand the timeline, let’s break down the mortgage application process into its key steps:

1. Pre-Approval (1-3 days)

The pre-approval process is an optional but highly recommended first step. During pre-approval, the lender will conduct a preliminary review of your financial situation, including your credit score, income, and debts. This can give you a better idea of how much you can borrow and help you narrow down your home search.

2. Formal Application (1-2 weeks)

Once you’ve found a property and made an offer, you’ll need to submit a formal mortgage application. This involves providing extensive documentation, including:

- Pay stubs

- Tax returns

- Bank statements

- Employment verification

- Gift letters (if applicable)

The lender will also pull your credit report and verify your income and employment.

3. Underwriting (1-4 weeks)

The underwriting process is where the lender thoroughly reviews your application and supporting documentation. An underwriter will assess your creditworthiness, income stability, and overall financial situation to determine if you qualify for the loan. During this stage, the lender may request additional documentation, which can delay the process.

4. Appraisal (1-2 weeks)

The lender will order an appraisal to determine the fair market value of the property you’re purchasing. This is an important step, as the lender wants to ensure the property is worth the amount you’re borrowing. The appraisal process can take 1-2 weeks, depending on the appraiser’s availability and any additional requirements.

5. Final Approval and Closing (1-2 weeks)

If your application is approved after underwriting and the appraisal, you’ll move on to the final approval and closing stage. During this time, you’ll review and sign the final loan documents and pay any closing costs. The lender will also coordinate with the seller’s team to schedule the closing date and arrange for the transfer of funds.

Tips for Speeding Up Your Mortgage Application

While the mortgage application process can take several weeks, there are steps you can take to potentially speed things up:

- Be Prepared with All Required Documentation: Gather all the necessary documentation ahead of time, including tax returns, pay stubs, bank statements, and any other financial records the lender may require. Having these documents ready can prevent delays caused by requests for additional information.

- Respond Promptly to Lender Requests: If the lender requests additional documentation or information, respond promptly to avoid unnecessary delays.

- Consider a Mortgage Pre-Approval: Getting pre-approved can help streamline the process once you find a property, as the lender has already conducted a preliminary review of your financial situation.

- Work with an Experienced and Efficient Lender: Choose a lender with a reputation for efficiently processing mortgage applications. Ask about their typical timelines and processes to ensure they align with your expectations.

- Avoid Making Major Financial Changes During the Process: While your mortgage application is in progress, avoid making significant financial changes, such as changing jobs or taking on new debt. These changes could impact your approval and potentially delay the process.

Wrapping Up: Patience and Preparation are Key

While the mortgage application process can take several weeks or even months, being patient and well-prepared can help streamline the experience. Remember, lenders are carefully evaluating your financial situation to ensure you can comfortably afford the mortgage payments.

Working with an experienced and reputable lender can also make a significant difference. They can guide you through the process, explain any delays or additional requirements, and help ensure a smoother overall experience.

Ultimately, starting the mortgage application process well in advance of your desired closing date can give you the time and flexibility needed to navigate any potential roadblocks or delays.

By understanding the factors that influence the timeline and following these tips, you can better prepare for the mortgage application process and increase your chances of a successful and timely home purchase.

“Meet Alena Genefair, a seasoned finance expert with over five years of experience and the esteemed author behind FinanceHookup. With a wealth of knowledge in financial management, investment strategies, mortgages, and banking, Alena provides insightful perspectives to readers. Her expertise helps individuals navigate the complexities of personal finance with clarity and confidence.”