In the competitive world of real estate, securing a mortgage can be a daunting task, especially for first-time buyers, individuals with limited income, or those with less-than-perfect credit histories.

However, guarantor mortgages offer a unique solution that can help overcome these obstacles and pave the way to homeownership. This in-depth article delves into the intricacies of guarantor mortgages, providing a comprehensive understanding of how they work, their requirements, and the pros and cons to consider.

What is a Guarantor Mortgage?

A guarantor mortgage is a type of mortgage that involves an additional party, known as the guarantor, who agrees to be legally responsible for the mortgage repayments if the primary borrower fails to make them. This arrangement can be particularly beneficial for individuals who may not meet the traditional lending criteria due to factors such as a low income, limited credit history, or a less-than-ideal credit score.

The guarantor’s role is to provide an additional layer of security for the lender, effectively co-signing the mortgage and pledging their own assets or income as collateral. By having a guarantor with a strong financial standing, the borrower’s application becomes more appealing to lenders, increasing their chances of securing a mortgage and potentially obtaining more favorable terms.

Guarantor mortgages are commonly sought by first-time buyers, young professionals, or those with irregular or low incomes who may struggle to meet the strict lending criteria of traditional mortgages.

Requirements for a Guarantor Mortgage

While the specific requirements for a guarantor mortgage may vary among lenders, there are typically two sets of criteria that need to be met: one for the primary borrower and another for the guarantor.

Primary Borrower Requirements:

- Minimum income: Most lenders will have a minimum income requirement for the primary borrower, although it may be lower than that for a traditional mortgage.

- Credit score: A less-than-perfect credit score may be accepted, as the guarantor’s creditworthiness can compensate for any shortcomings.

- Deposit: A higher deposit (typically 10-20% of the property value) may be required to offset the perceived higher risk.

Guarantor Requirements:

- Excellent credit history: The guarantor must have an excellent credit score, usually above a certain threshold set by the lender.

- Stable income: The guarantor’s income should be sufficient to cover both their own expenses and the mortgage payments if needed.

- Asset ownership: Some lenders may require the guarantor to have a specific level of assets, such as equity in their own property or investments, which can serve as additional security.

- Age: Guarantors are typically required to be within a certain age range, often between 21 and 75 years old.

It’s important to note that while some lenders may offer guarantor mortgage programs, not all do. It’s essential to research and compare lenders to find those that provide this type of mortgage and assess their specific requirements.

How Guarantor Mortgages Work

The process of obtaining a guarantor mortgage involves several steps:

- Application: The primary borrower and the guarantor jointly apply for the mortgage, providing the necessary documentation and financial information.

- Assessment: The lender evaluates the borrower’s and the guarantor’s creditworthiness, income, assets, and overall financial stability.

- Legal Agreement: If approved, both parties sign a legal agreement that outlines the terms and conditions of the mortgage, including the guarantor’s obligations.

- Ongoing Payments: The primary borrower is responsible for making the monthly mortgage payments as agreed upon.

- Default Scenario: If the borrower fails to make the required payments, the lender can legally pursue the guarantor to cover the outstanding balance, interest, and any associated fees.

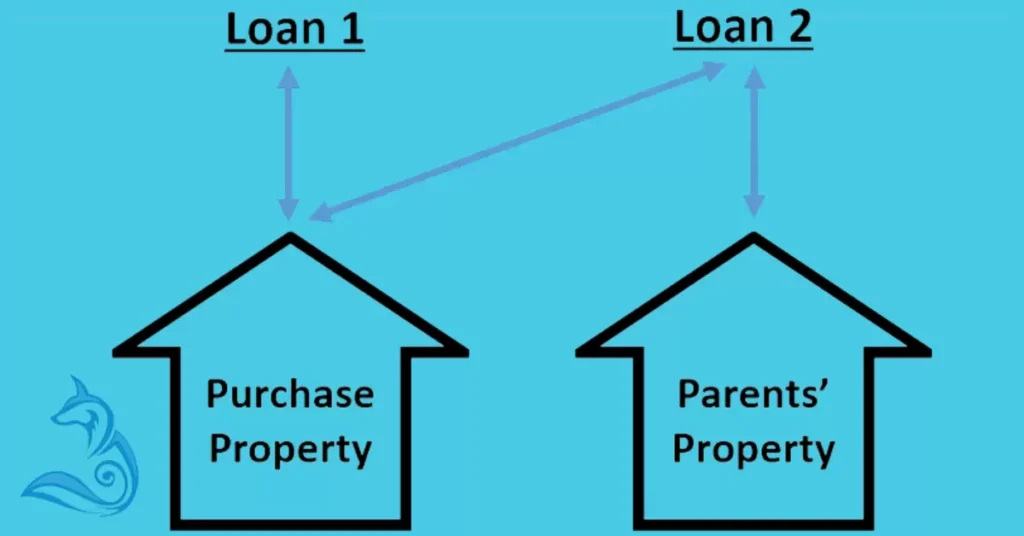

Here’s an example scenario to illustrate how a guarantor mortgage works:

John, a recent graduate, wants to purchase his first home but doesn’t have a substantial income or credit history. His parents, who have a solid financial standing, agree to act as guarantors. The lender approves John’s mortgage application based on his parents’ creditworthiness and income stability. John makes the monthly payments as agreed, and his parents are not financially responsible unless he defaults on the loan.

Pros and Cons of Using a Guarantor

Like any financial arrangement, guarantor mortgages come with both advantages and potential drawbacks that should be carefully considered:

Pros:

- Increased Chances of Approval: With a guarantor’s financial backing, borrowers have a higher likelihood of being approved for a mortgage, even with limited income or credit history.

- Lower Downpayment: Some lenders may allow a lower downpayment requirement when a guarantor is involved, making homeownership more accessible.

- Building Credit History: By responsibly making mortgage payments, borrowers can establish and improve their credit scores, setting the stage for future financial opportunities.

- Family Support: Guarantor mortgages can provide a way for family members to assist their loved ones in achieving homeownership goals.

Cons:

- Risk to the Guarantor: If the borrower defaults on the mortgage, the guarantor becomes legally responsible for the outstanding payments, potentially jeopardizing their own financial well-being.

- Strained Relationships: Financial obligations can strain personal relationships between the borrower and the guarantor, particularly if difficulties arise in making payments.

- Limited Lender Options: Not all lenders offer guarantor mortgage programs, potentially limiting choices and flexibility.

- Higher Interest Rates: In some cases, guarantor mortgages may come with higher interest rates due to the perceived higher risk.

Alternatives to Guarantor Mortgages

While guarantor mortgages provide a viable solution for many, they may not be the best fit for everyone. It’s essential to explore alternative options that could better suit your circumstances:

- FHA Loans: Insured by the Federal Housing Administration, these loans have more lenient credit score and downpayment requirements, making them an attractive choice for first-time buyers or those with limited funds.

- Conventional Mortgages with a Co-Borrower: Similar to a guarantor mortgage, a co-borrower with a strong financial profile can increase the chances of approval and potentially secure better terms.

- Improving Credit and Saving for a Larger Downpayment: Dedicating time to improve your credit score and saving for a larger downpayment can open up more conventional mortgage options in the future.

Ultimately, the decision to pursue a guarantor mortgage should be based on a careful evaluation of your specific circumstances, financial goals, and the potential impact on personal relationships.

Tips for Guarantors

If you’ve been asked to act as a guarantor for a mortgage, it’s crucial to understand the gravity of the commitment and take steps to protect your financial well-being:

- Understand Your Legal Obligations: Seek professional legal advice to fully comprehend the extent of your financial responsibilities as a guarantor and the potential consequences of default.

- Set Clear Expectations: Have an open and honest discussion with the borrower about the terms of the agreement, payment expectations, and contingency plans if circumstances change.

- Monitor the Borrower’s Payments: Stay informed about the borrower’s payment history and financial situation to identify potential issues early on.

- Consider Life Events: Anticipate how significant life events, such as job changes, marriage, or retirement, could impact your ability to fulfill the guarantor’s role in the future.

- Explore Exit Strategies: Inquire about the process and conditions for being released from the guarantor agreement, should circumstances warrant it.

- Protect Your Assets: Consult with a financial advisor to ensure that your personal assets and financial stability are adequately safeguarded in the event of a default scenario.

By taking a proactive approach and seeking professional guidance, guarantors can make informed decisions and mitigate potential risks associated with this significant financial commitment.

Conclusion

Guarantor mortgages offer a unique opportunity for individuals with limited income, credit history, or financial resources to achieve their dream of homeownership. By leveraging the financial strength of a guarantor, borrowers can overcome traditional lending obstacles and secure a mortgage they might not have qualified for otherwise.

However, it’s essential to approach guarantor mortgages with a thorough understanding of the requirements, processes, and potential implications for both parties involved. Carefully weighing the pros and cons, exploring alternative options, and seeking professional legal and financial advice can help ensure that this arrangement aligns with your long-term goals and personal circumstances.

If you’re considering a guarantor mortgage, take the time to research reputable lenders that offer these programs, assess your eligibility, and have open and honest conversations with potential guarantors. With the right preparation and a solid plan in place, a guarantor mortgage can be a valuable tool for unlocking the door to homeownership and building a secure financial future.

Remember, the journey to homeownership is unique for everyone, and a guarantor mortgage may.

“Meet Alena Genefair, a seasoned finance expert with over five years of experience and the esteemed author behind FinanceHookup. With a wealth of knowledge in financial management, investment strategies, mortgages, and banking, Alena provides insightful perspectives to readers. Her expertise helps individuals navigate the complexities of personal finance with clarity and confidence.”